Hon’ble Prime Minister Shri Narendra Modi convened a pre-Budget consultation meeting with eminent economists and sectoral experts, including individuals with policy and industry experience. The meeting, attended by senior government officials, policy ecosystem experts, and NITI Aayog representatives, focused on seeking inputs and suggestions on “mission‑mode reforms” across sectors to boost growth and efficiency.

Hon’ble Finance Minister has already begun pre‑Budget consultations with various stakeholders. The Union Budget is expected to be presented on 1 February 2026 or 2 February 2026, as 1 February 2026 falls on a Sunday. In any case, the Budget will be presented within the overall framework and objective of achieving “Viksit Bharat 2047”.

This Budget is expected to focus on capital outlay, with special emphasis on policies for emerging growth areas such as:

- Data Centres

- Artificial Intelligence (AI)

- Robotics

It is also expected that policies will be framed to promote technology-led growth in areas where young professionals can be employed, thereby creating new employment opportunities.

Further, in view of tariff barriers imposed by the US, policies may be designed to strengthen the manufacturing sector, promote MSMEs, and diversify exports to reduce dependence on limited markets and improve trade resilience. Therefore, the Government may introduce measures aligned with technology-led growth, investment-led reforms, stronger global competitiveness, and sector-specific, mission-mode execution—not just broad allocations.

- Technology-led growth

- Investment-led reforms

- Stronger global competitiveness

- Sector-specific, mission-mode execution—not just broad allocations

Further, the Government is expected to focus on capital infrastructure coupled with next-generation priorities such as advanced manufacturing, AI/digital public infrastructure, logistics efficiency, and tech and innovation ecosystems. These priorities may be reflected in railways, roads, ports, warehousing, etc.

One expectation from this Budget is that it will reinforce the credibility of deficit numbers, particularly against the backdrop of the FY26 fiscal deficit running at 62.3% of the annual target by November (as per government data reported by Reuters).

Now, we focus on Direct Tax and Indirect Tax:

Direct Tax:

Since the Income Tax Act, 2025 is expected to come into effect from 1 April 2026, no major changes are anticipated in the new Act. However, to stimulate consumption, it is expected that the standard deduction for salaried employees may be increased and tax slabs/rates under the new simplified regime may be rationalised.

It is also expected that provisions relating to long‑term capital gains will be simplified and tax relief may be provided through a reduction in the applicable tax rate.

Many taxpayers have received notices/letters relating to investigations and faceless assessment schemes. It is expected that the process will become more transparent and that mechanical notices and replies will be avoided. Instead, assessments should involve genuine application of mind, including granting personal hearings through video conference or electronic mode. Ease of doing business and reduction in litigation should be key focus areas.

Indirect Tax:

- Customs:

The Customs Act was enacted in 1962. Although amendments are made every year, there have not been many substantive changes. Self‑assessment was introduced, but there has not been a substantial reduction in clearance time for import/export cargo. It is expected that export and import clearances should be enabled at Customs ports and completed within a maximum of 24 hours. However, despite the ICEGATE portal, importers and exporters still face procedural delays and higher transaction costs.

It is expected in this Budget that there will be no need to rely on Customs House Brokers and that all export and import documents should be filed directly from the desktop through a simplified e‑system. Accordingly, there is a need to revamp the existing ICEGATE portal and procedures to enable a simpler and more user‑friendly mechanism for filing import and export documents.

At present, even after the introduction of self‑assessment, interaction with Customs through CHBs remains common. This is seen as a root cause of corruption and red tape. There are also more than 70 rules and regulations. It is time to substantially reduce and rationalise these rules, simplify the mechanism, and limit compliance requirements so that importers and exporters can follow them more easily.

Further, in light of Supreme Court and High Court judgments under the self‑assessment framework, there is a need to revisit demand notices issued under Section 28 (as against filing appeals against such Bills of Entry). Suitable amendments may be required to provisions relating to appeals and demands.

It is important to rationalise the Customs tariff by giving effect to Free Trade Agreements (FTAs) and making available a separate compendium (HSN-wise) of applicable rates under different FTAs. While such information is available on www.trade.gov.in, it should be updated promptly and a mechanism should be introduced to maintain a regularly updated compendium.

Preferential tariff notifications under FTAs should be updated and the relevant notification references should be clearly mentioned.

To conclude, there is a need to rationalise the provisions of the Customs Act to avoid litigation and achieve the objective of ease of doing business, while reducing transaction costs and time. The focus should be on eliminating the mandatory dependence on Customs House Brokers and limiting their role to coordination with freight forwarders and logistics (loading/unloading and transportation). Reducing their role in the compliance chain could help curb corruption and improve efficiency.

- GST:

We have experienced buoyancy in the economy, market growth, an increase in GDP, and higher tax collections even after the 56th GST Council recommended reductions in tax slabs, including changes involving the 12% and 28% rates.

Despite the imposition of US tariffs, the economy has remained resilient and expected GDP growth is around 6.8%. Trade and industry have consistently responded positively whenever simplification measures were introduced with the objective of improving ease of doing business. They have reciprocated this with trust and transparency.

It was expected that “One Nation, One Tax” would achieve the objective of ease of doing business and, except for initial teething problems along with GSTN glitches and delays in implementation, trade and industry at large have accepted GST as a good and simple tax.

However, industries have faced significant litigation due to issues in GSTN implementation, including issuance of numerous show cause notices and adjudications arising from mismatch provisions. There is an urgent need to amend provisions relating to input tax credit (ITC) availment and avoid litigation where recipients are forced to reverse ITC due to supplier defaults. Authorities should focus on collecting tax from errant suppliers rather than disallowing ITC to recipients.

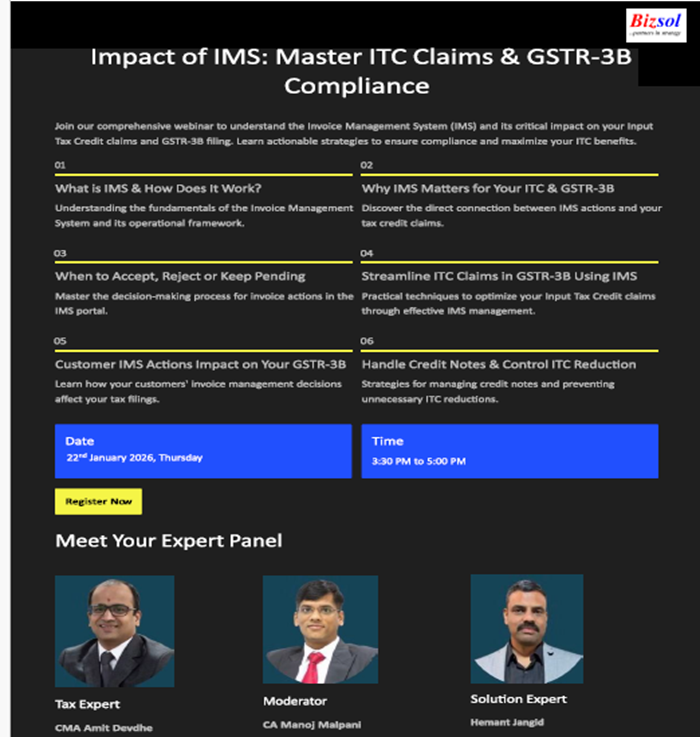

The Government introduced the IMS system, but concerns remain that if a credit note is rejected by the recipient, the taxpayer’s liability may unnecessarily increase. Therefore, acceptance of credit notes through IMS should be reconsidered and the proviso to Section 34(2) of the CGST Act should be implemented in its true spirit. Refund provisions should be simplified, especially refunds arising from inverted duty structures, as accumulation of ITC in certain sectors is causing liquidity issues.

It is also high time to include petroleum products and immovable property within the GST framework. Provisions relating to blocked credit should be reviewed and withdrawn to the extent possible, since the principle of avoiding cascading taxes cannot be fully achieved otherwise. Trade and industry are eagerly awaiting this Budget and expect renewed momentum for growth across all sectors to achieve the dream of “Viksit